Our Businesses

The Mangatu Group has four key investment areas: Forestry, Carbon, Food and Passive assets.

We continue to work with these investments and look to explore other options as pressure and viability in some industries become challenging. Diversification and leadership are key, while balancing the protection and improvement of the whenua, awa, ngahere and taiao.

Each pānui will provide an update on one or more of our business areas and any significant changes to our portfolio or strategy. For a general view of our investments visit this page: Businesses.

In this edition however, we focus on our kaimahi and forestry venture.

In the next edition we will discuss our farming business.

FORESTRY

Mangatu today holds nearly 15,000 hectares in indigenous forest and another 15,000 hectares in exotic trees – primarily pinus radiata (pine). Since 2017, we have planted more than 6,000 hectares converting low performing farmland into production grade forest. The benefit of these forests coming from both potential forest production returns and carbon.

Over 2023 and 2024 the focus has been on ensuring forests are healthy, robust, and producing appropriate levels of trees for potential future harvesting. The largest impact of this has been from pest and stock issues and has led to two years of blanking (filling forest growth gaps with trees) and replanting in some areas.

Over May, June and July of each year forest contractors work on preparing areas, planting and then releasing the trees. Minor pockets of land are planted if they were missed during previous planting seasons. There are areas which are left for forest reversion (nature recloaking the whenua) or held for future opportunities.

We continue to thin forests which is a standard practice to ensure that the forest grows towards optimum harvest production sizes and grades. We do not prune most of the forests as the cost outweighs the returns for Mangatu. There are some forest blocks closer to town where pruning is more viable.

The local forestry industry over the past two years has been significantly impacted by bad actors and a system now struggling to find its feet again. Industry has lost its ‘social license’ to operate and turning to whenua Māori for support. We acknowledge the impact on our owners with slash and debris devastating lives and communities. We are working with industry, the Council and other whenua Māori to find a future for forestry within better and more secure regulations. We are exploring other markets rather than all production going to China. Forestry is a key investment and industry for our rohe and Mangatu. Many owners rely on this industry for work, income, and future prosperity. Our role is to support a better way forward for our community and owners while also ensuring we have an avenue for owner prosperity.

Each pānui will provide an update on one of our business areas and any significant changes to our portfolio or strategy. For a general view of our investments visit this page: Businesses

UNDERSTANDING THE CANADA INVESTMENT

Our venture into Canada was based on our New Zealand food production experience in farming, processing and international sales which occurred over more than 20 years.

What follows is a timeline of the history of the investment and its overall impact on the financial stability of the Mangatu Group today.

TIMELINE

| 1994 | Gary Alexander was appointed as the first Mangatu CEO, primarily to grow and develop the transition of Mangatu from traditional pastoral farming to an international food business. Mangatu moved from 18 individual farm operations to a focused, combined farm production system adopting new genetics and production systems to support an integrated approach. |

| 2003 to 2012 | Integrated Foods Limited (IFL) was created to develop a food business with a recognised corporate structure as well as to remove commercial business risk from the whenua. IFL acquired a meat marketing company later rebranded as Integrated Foods Marketing (IFM). This acquisition was intended to acquire expertise and gain control of the sales, marketing and branding of IFL produced lamb. IFL also purchased Fresh Meats NZ Limited (FMNZ), an export licensed lamb processor in Napier. Following the initial investment and start-up years FMNZ, along with IFM, became a profitable part of the Group. |

| 2013 | From years of processing and sales experience, IFL determined that the most lucrative, yet underserviced, lamb market was in North America. Where only 40% of the lamb consumed was produced domestically. The strategy was to build a footprint in North America to develop year-round supply of both domestic and NZ lamb and control production, processing and marketing in both NZ and domestically. The goal was to become a major, fully integrated, domestic player in the North American lamb industry and “pull in” IFL NZ product. Selling to ourselves in North America rather than to third party traders. The seasonal production in New Zealand from IFL fit perfectly in the international season differences with North America by filling the lower lamb supply periods there when NZ is in peak lamb supply. The first step in the strategy was to build a significant sheep breeding flock. Sheep farming in North America is essentially a cottage industry with scattered and inconsistent lamb supply for development of proper processing and marketing. In conjunction with a Canadian partner, Canada Sheep and Lamb Farms (CSLF) was formed in Manitoba, Canada. This initial partnership included 3,500 Rideau Arcott ewes which were developed by Canadian Government researchers to have maternal genetics with ability to breed year-round, producing multiple lambs and rearing those lambs to weaning. The next few years were spent building the Canada flock by acquiring land and developing large scale breeding and lamb growing facilities in Manitoba. Progress on CSLF development and growth was continually reported each year to the Mangatu shareholders as the breeding flock grew as projected with IFL shareholding of CSLF growing to exceed 80%. |

| 2016 | With the CSLF sheep farming and lamb production well underway (with more than 25,000 breeding ewes) lamb finishing and processing was the next step to create true vertical integration of the Canada business. A group of Canadian cattle feedlot operators was identified as having an underutilised lamb finishing unit and processing plant. Having these complementary assets, significant lamb production at CSLF combined with lamb finishing and processing, made a strong business case for merger of these assets. Discussions and negotiations to try to achieve a merger began. |

| 2018 | The merger of CSLF and the finishing and processing assets was completed in August 2018 resulting in the formation of the North American Lamb Company (NALCO). Ownership was structured at 50% for CSLF (IFL) and the merger partner. IFL to acquire a majority shareholding and control over time. Thanks to the merger, NALCO became the largest vertically integrated sheep business in North America. During this time NALCO was awaiting bank funding to build two important breeding facility projects that were required by early 2019 for lambing ewes. Funding was held up by procedural issues losing a full year due to the Canadian winter where earthworks and building is not possible. This put lamb production for finishing and processing behind by more than 12 months as well as incurring additional costs for feeding non-productive ewes that were being held up from entering the breeding cycle. |

| 2020 | Covid-19 hit in early 2020 and the world went into total shutdown. Limiting labour and management ability to travel and function as normal. By the end of 2020 feed grain prices (sourced to feed our livestock) had increased by 25%, the start of a significant upward trend of costs. Feed making up 50% of the cost of maintaining a breeding ewe and 70% of finishing lambs. By April of 2020 the first of the two new breeding facilities was completed with the second completed in July. |

| 2021 | The Covid lockdowns and subsequent issues continued to rage on. Drought in the Canada spring of 2021 caused a major spike in the price of livestock feed as grain prices continued to increase as well. By late 2021 both grain and forage prices had increased by more than 50% from the levels prior to Covid. With the new facilities operational, NALCO continued to make production gains. For the year ending October 2021 over 30,000 ewes lambed with close to 60,000 lambs were bred. Lamb mortality was however much higher than forecast, particularly in first time lambing ewes. |

| 2022 | In February 2022 the Russia/Ukraine war escalated. This gave another significant increase in feed prices particularly feed grains which more than doubled in price from mid-2020. Farm labour and other input costs were also steadily increasing as well. Production continued to increase and by the end of July 2022 30,000 ewes had lambed since October 2021 a 22% increase over the same time the year previous resulting in increasing lamb production. Lamb inventory on the finishing facility from May 2021 onward showed continued improvement in numbers on hand which were now all sourced from NALCO breeding farms in contrast to significant third-party lambs purchased in past years. Processing numbers were as forecast and the plant operation was viable because of the lamb supply from NALCO, otherwise reliance on the third-party lamb supply made this operation questionable. The meat sales results that were achieved confirmed the large lamb price difference between Canada and NZ – a significant opportunity confirmed for the Group. Unfortunately, the continual increase in lamb production could not keep pace with the rising costs of production resulting mostly from world events and no relief in sight. All in all, by early 2022 the cost of producing a finished live lamb to processing was now more than 50% greater than forecast and nearly three times more expensive than the cost in 2018. All this resulting in large losses which could not be solved by sales price, production or other solutions. The large forecasted losses for future years, and the subsequent multimillion dollar cash investment required to continue, was not supported by the NALCO shareholders. As such the IFL Board and the Mangatu Committee of Management deemed the continuation of the Canada venture to be unviable and made the painful decision to exit the total Canada business in the most efficient manner possible. |

THE FINANCIAL IMPACT

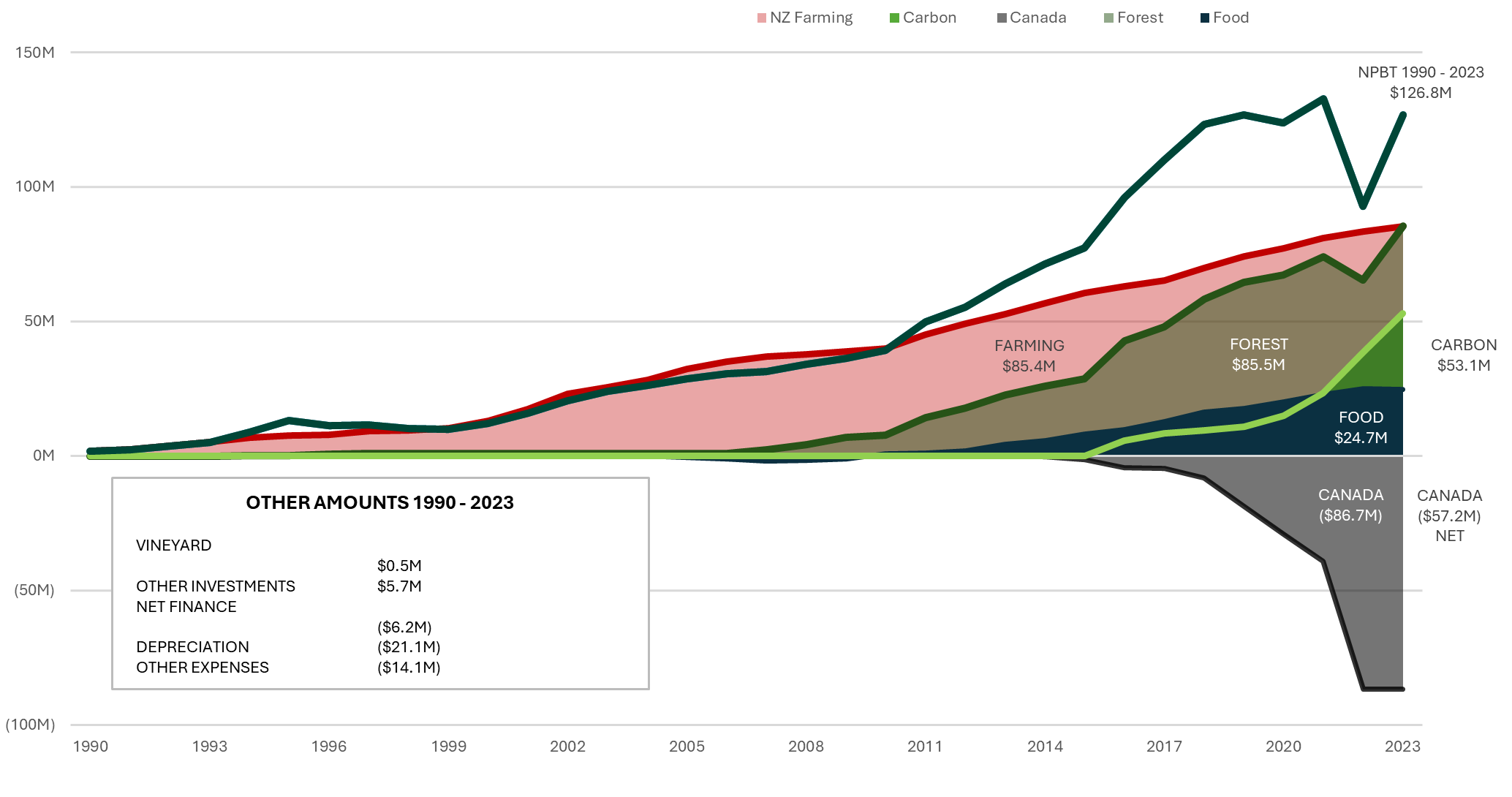

As explained in the timeline, IFL was not 100% owner of NALCO. However, because IFL was the larger shareholder in NALCO it had to report to owners, through financial statements and annual reports, 100% of any income or losses through its Group Profit and Loss. For this reason, it can become unclear as to the actual losses taken by IFL and the Mangatu Group. We are not excusing the losses, as they were large, but below explains the split of losses related to each partner.

| TOTAL CANADA LOSSES | PARTNER PORTION | IFL PORTION | |

| 2014 | (204,000) | 97,000 | (301,000) |

| 2015 | (1,029,101) | (5,000) | (1,024,101) |

| 2016 | (3,194,200) | (718,000) | (2,476,200) |

| 2017 | (160,456) | 641,000 | (801,456) |

| 2018 | (3,567,000) | (655,000) | (2,912,000) |

| 2019 | (10,521,000) | (6,373,000) | (4,148,000) |

| 2020 | (10,467,000) | (6,440,000) | (4,027,000) |

| 2021 | (9,918,000) | (5,039,000) | (4,879,000) |

| 2022 | (47,637,000) | (11,006,000) | (36,631,000) |

| TOTAL | (86,697,757) | (29,498,000) | (57,199,757) |

What the above table shows is that over the life of the Canada investment $86.7M was lost through the operational building up and then final ‘fire sale’ of assets in 2022. Of this value, which is shown 100% in the Mangatu financial statements, $29.5M belongs to merger partners while $57.2M relates to the IFL and Mangatu Groups. The $29.5M portion of the losses can be found as part of the “Movements in Equity” report in the annual financial statements – under Minority Interest.

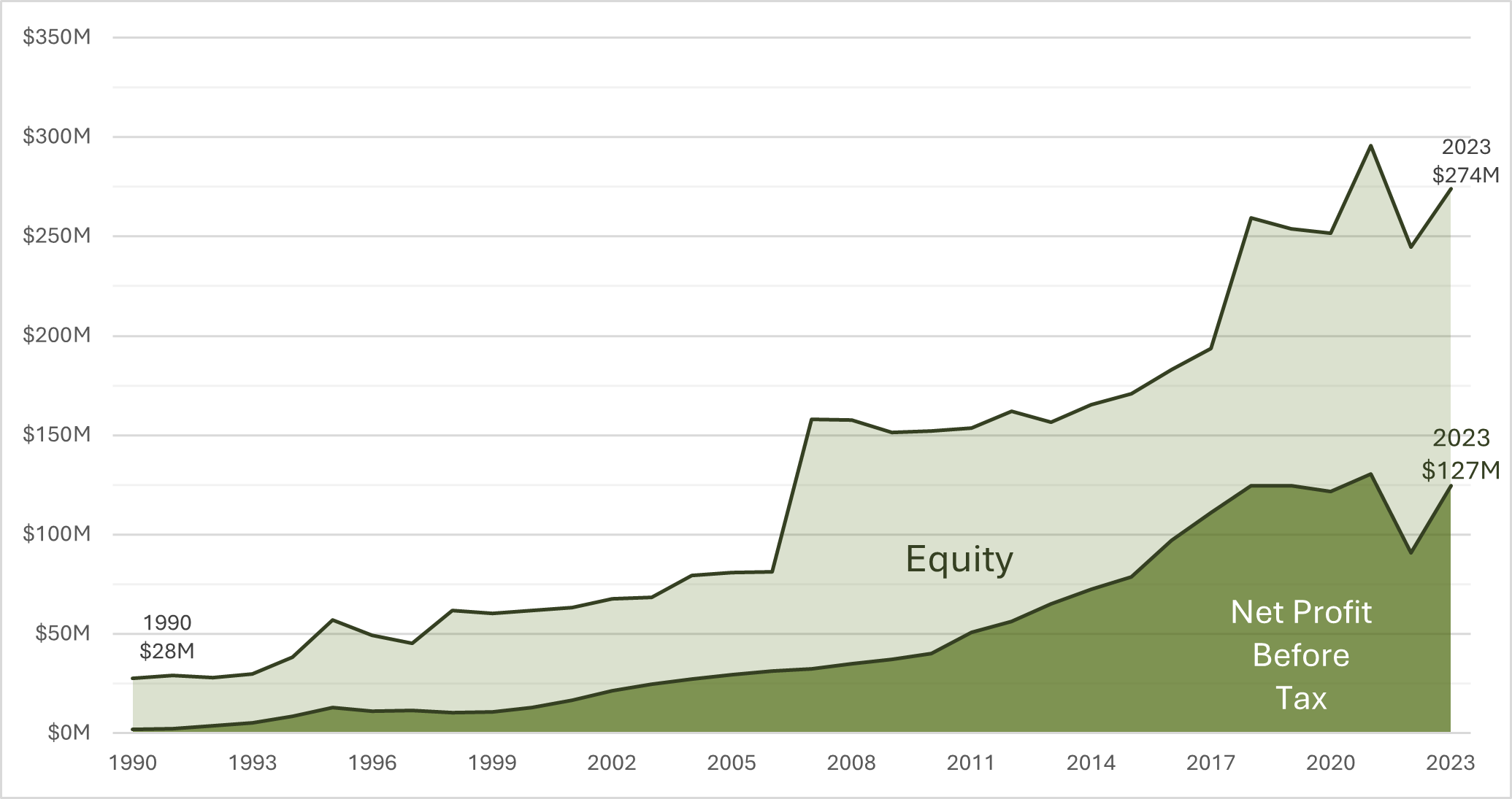

MANGATU – STRONG FINANCIAL POSITION & RETURNS

Mangatu continues to be one of the strongest entities leading industry in the region, even with the profound impact of Canada.

The Incorporation has grown from $28M in equity to $274M in equity over 30 years. All while paying out $32M in distributions to owners over this time.

Over this same 33 years total net profit before tax generated was $127M – including the losses in Canada and the growth in the forestry asset. Farming, food and carbon have all contributed to the revenue and provided the cash to support distributions and investments like Canada.

From discussions with owners, it was clear that more work was needed to support the owners understanding of what happened in Canada and to dispel any uncertainty or misinformation.

The biggest concern being the transparency of transactions and what happened to the money.

The investment in Canada was focused on improving returns for owners through farming and food – industries Mangatu and IFL knew well.

Once invested into the venture however there was significant commitment required ($50M+) to fund infrastructure and growth. Ultimately, following that investment, the shutdown of the venture was required, and the value provided for buildings, assets, animals and operations was lost.

NAPIER STAFF VISIT MANGATU

On the 24th of April the Mangatu head office held a farm tour for the staff from Fresh Meats and wider IFL farm staff.

We wanted to bring the teams together to introduce all staff to our amazing building, mahi, and connect our Mangatu vision and values with their own mahi.

Mangatu CEO, David, presented parts of the shareholder engagement presentations so our staff understood what was being discussed with owners and the importance of their mahi to the owners.

The value of whakawhanaungatanga was felt straight away by all staff. Connecting the history and story of Mangatu gave some sense of purpose for everyone. The staff from Napier were given the opportunity to visit our conference room, boardroom and then onto two farms closer to town.

All staff, including those based in Tairāwhiti, were energised by the time spent together. We will continue to connect our kaimahi with Mangatu and know this will grow the sense of pride in both Mangatu and IFL respectively.

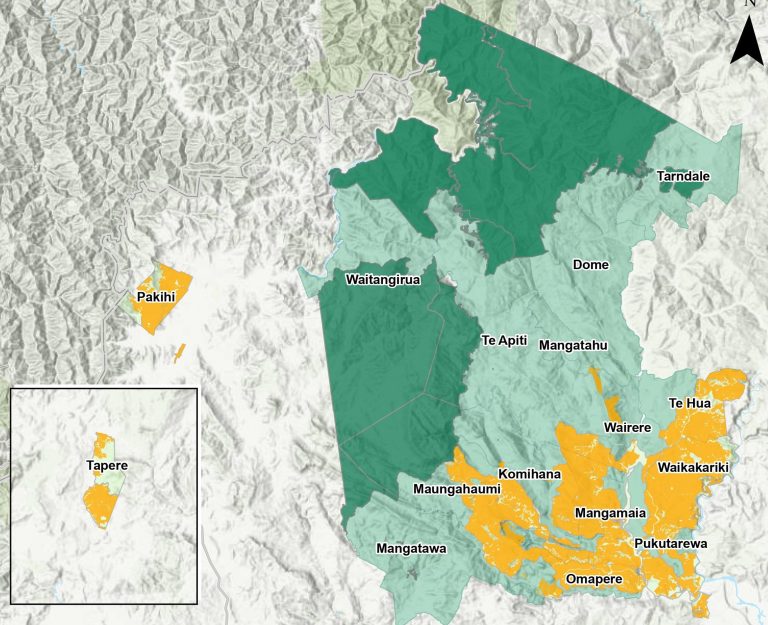

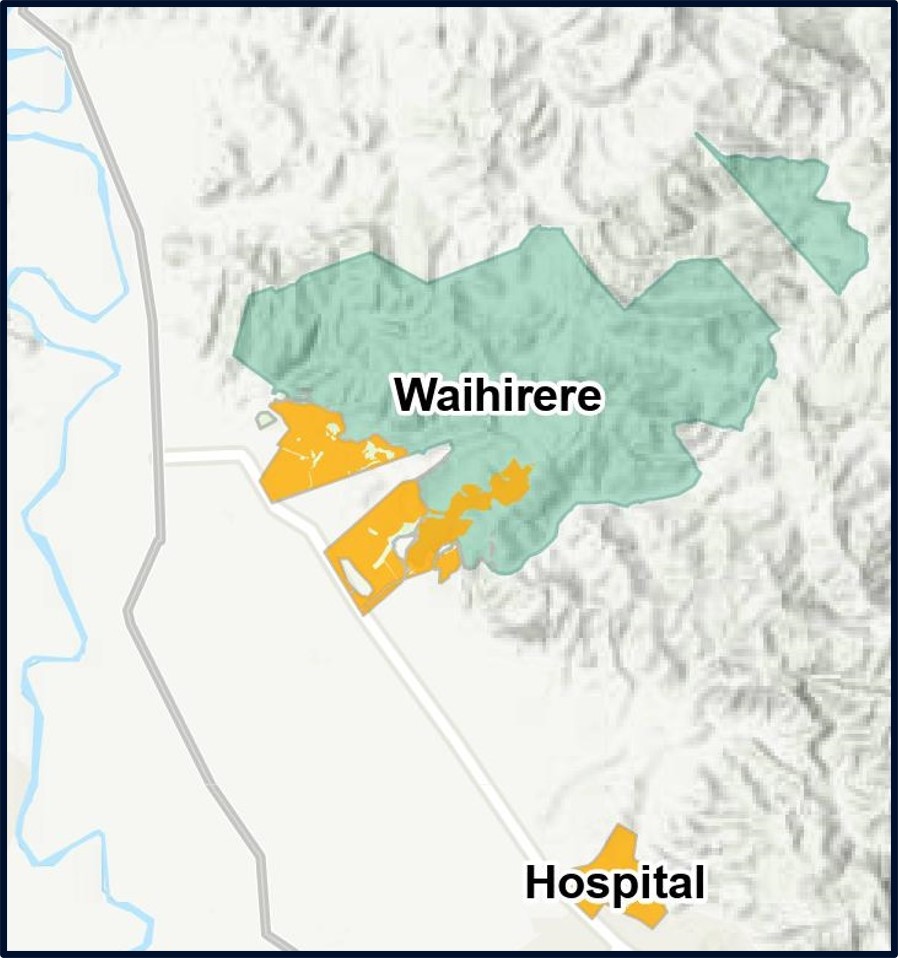

SALE OF HOUSES ON MANGATU

We have eight houses for sale which are surplus to farm and forest operations.

- Maungahaumi Shepherd’s House

- Pukutarewa Shearers Quarters

- Wairere Single Men’s Quarters

- Depot House – Mangaparae

- Te Hua Shepherd’s Quarters

- Mangatahu Shepherd’s Quarters

- Komihana Single Men’s Quarters

- Komihana Married Shepherd’s Quarters

We would like to offer these houses, as they are, to our owners via a tender process. A tender process is where a legal offer to buy the houses is made not knowing the bids of other buyers. The bidder with the highest price will likely purchase the home if all other conditions are met. Ritchie Matenga (Email Ritchie) is available to support owners though this process which may include access to our legal team to prepare tenders. We (Ritchie) have worked with a local house mover contractor to source quotes for owners for removing the homes and transporting to Whatatutu village. We still expect buyers to consider their own costs and our quotes are there to help you make your decision.

Tender bids (offer price) should be for the house only as removal, transport, and resettling of the house is at the cost of the buyer. We also recommend considering insurances and building consents before buying – these considerations and costs will also be for the buyer to cover.

A schedule of the homes is available by emailing Ritchie or can be collected from the Mangatu office. This schedule includes summary information on the homes and transport costs. An ’open home day’ is organised for potential buyers on 13 July 2024. Buyers will meet at the IFL depot and be guided to the homes. Those houses accessible by four-wheel drive only will be highlighted in advance.

Tenders close 10am 31 July 2024. Decision by 5pm 02 August 2024. Payment due by 4pm 31 August 2024. Any unsettled houses will then be offered to the next highest bidder or in the event of no other bidders will be offered to the public. Houses are expected to be lifted and removed over the spring (Sept – Nov) of 2024.

NAPIER STAFF VISIT MANGATU

On the 24th of April the Mangatu head office held a farm tour for the staff from Fresh Meats and wider IFL farm staff.

We wanted to bring the teams together to introduce all staff to our amazing building, mahi, and connect our Mangatu vision and values with their own mahi.

Mangatu CEO, David, presented parts of the shareholder engagement presentations so our staff understood what was being discussed with owners and the importance of their mahi to the owners.

The value of whakawhanaungatanga was felt straight away by all staff. Connecting the history and story of Mangatu gave some sense of purpose for everyone. The staff from Napier were given the opportunity to visit our conference room, boardroom and then onto two farms closer to town.

All staff, including those based in Tairāwhiti, were energised by the time spent together. We will continue to connect our kaimahi with Mangatu and know this will grow the sense of pride in both Mangatu and IFL respectively.

SALE OF HOUSES ON MANGATU

We have eight houses for sale which are surplus to farm and forest operations.

- Maungahaumi Shepherd’s House

- Pukutarewa Shearers Quarters

- Wairere Single Men’s Quarters

- Depot House – Mangaparae

- Te Hua Shepherd’s Quarters

- Mangatahu Shepherd’s Quarters

- Komihana Single Men’s Quarters

- Komihana Married Shepherd’s Quarters

We would like to offer these houses, as they are, to our owners via a tender process. A tender process is where a legal offer to buy the houses is made not knowing the bids of other buyers. The bidder with the highest price will likely purchase the home if all other conditions are met. Ritchie Matenga (Email Ritchie) is available to support owners though this process which may include access to our legal team to prepare tenders. We (Ritchie) have worked with a local house mover contractor to source quotes for owners for removing the homes and transporting to Whatatutu village. We still expect buyers to consider their own costs and our quotes are there to help you make your decision.

Tender bids (offer price) should be for the house only as removal, transport, and resettling of the house is at the cost of the buyer. We also recommend considering insurances and building consents before buying – these considerations and costs will also be for the buyer to cover.

A schedule of the homes is available by emailing Ritchie or can be collected from the Mangatu office. This schedule includes summary information on the homes and transport costs. An ’open home day’ is organised for potential buyers on 4 August 2024. Buyers will meet at the IFL depot and be guided to the homes. Those houses accessible by four-wheel drive only will be highlighted in advance.

Tenders close 4pm 30 August 2024. Decision by 4pm 06 September 2024. 10% of the purchase price is payable on the signing of the Sale and Purchase agreement. Full payment is due by 4pm 27 September 2024. Any unsettled houses will then be offered to the next highest bidder or in the event of no other bidders will be offered to the public. Houses are expected to be lifted and removed over the spring (Sept – Nov) of 2024.